The Best Short-Term Disability Insurance In 2025

Short-term disability insurance may not have crossed your mind before, but what would you do if you were injured or became ill? Would you still be able to support yourself and your loved ones even if you were unable to work for a short period of time?

A study by LIMRA and Life Happens (1) showed that over 60% of Americans would not be able to maintain their lifestyle after six months following a sudden illness or short-term disability. The effects of 6 months of income loss can be devastating, causing you to dip into your savings and setting you back in terms of retirement.

Short-term disability insurance provides you with that added peace of mind and a much-needed safety net should something unexpected happen.

Here is everything you need to know about this type of insurance, the benefits thereof, and the providers you should consider.

What is Short-Term Disability Insurance?

Short-term disability insurance would replace a portion of the income you would lose should you be unable to continue working for a short period of time.

Once you are diagnosed with a qualifying illness or injury, most insurers would cover you for a period of up to 6 months. However, this period may differ based on the provider you choose.

Beneficiaries will continue to receive payouts until they are able to return to work or they reach the end of their benefit period.

How Does Short-Term Disability Work?

With a short-term disability policy, you would be able to submit a claim should you become too sick to continue working over the short term. Your insurance provider would require specific information from your doctor to be considered for approval.

This medical documentation would outline your injury or illness in detail, which is used to assess your claim. Once approved, the benefits will be paid directly to you, and you can spend this money as you see fit.

Short-Term vs. Long-Term Disability Insurance

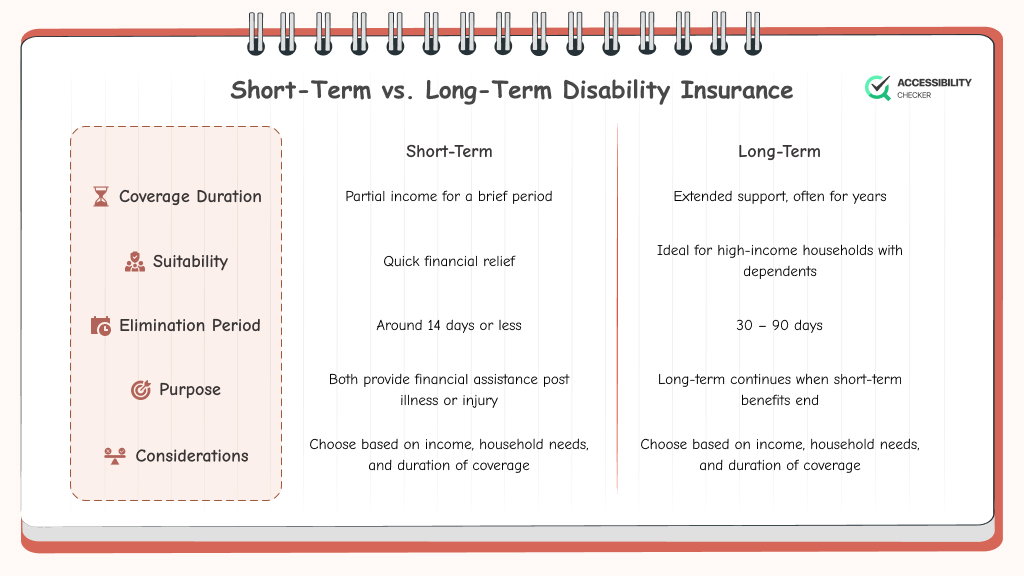

Both long and short-term disability insurance are designed to provide someone with financial assistance following an illness or injury that prevents them from working. However, there are some small nuances to be aware of.

With a short-term policy, you will only receive a portion of your income for a shorter period of time. Long-term policies, on the other hand, will continue paying after any short-term payments have run out, usually for several years. Long-term disability insurance is generally a better option for high-income households that have several dependents.

The elimination period also differs between these two types of policies. The elimination period for short-term disability policies is around 14 days or less. Long-term policies range from 30 – 90 days.

An elimination period refers to the period between the time you are injured or fall ill and when you start receiving your benefits.

Who Qualifies for Short-Term Disability?

Medical problems and job loss due to injury are two of the most common reasons why someone would eventually need to file for bankruptcy. This is because most people aren’t able to make it past the 6-month mark should they be unable to work. This is where short-term disability insurance comes into play.

Injuries, mental health concerns, and musculoskeletal issues are all qualifiers for short-term disability claims. It’s important to check the specific terms and conditions of your policy to determine which conditions and types of injury are exempt from coverage.

It should be noted that short-term disability insurance is not the same as Workers’ Compensation. This specific type of coverage is linked to injury and illness that is unrelated to your job.

How Much Does Short-Term Disability Pay?

The average policy pays out anything between 40% and 70% of your monthly income until you can start working again. There will also be a policy end date. Should you not be able to start working again from that date, payments will also stop. All payments automatically stop if you’re able to return to work, even if the policy end date hasn’t arrived yet.

When Does Short-Term Disability Kick In?

This mainly depends on the insurance provider and policy you decide on. In most instances, short-term disability coverage kicks in anywhere from 7 – 14 days following a claim.

If you have a disability policy with your employer, many of them will require you to first utilize your accrued sick days before any benefits will kick in.

Top 6 Recommended Short-Term Disability Insurance Providers

Now that you have a better understanding of what short-term disability insurance is all about let’s take you through some of our recommended providers.

1. Mutual of Omaha

Mutual of Omaha has been around for over 100 years and is one of the most well-known names in the short-term insurance space. Benefits range from $300 – $20,000 per month, depending on your monthly income.

Even though you will need to speak to an agent to sign up for a plan, this is a great way to better understand the different policies and what you qualify for. Mutual of Omaha also offers automatic increase benefits and social security supplementation. For those who are self-employed, you could qualify for a 15% discount.

Premiums range from $10 – $60 per month, and the elimination period is between one and 24 months.

Overall, Mutual of Omaha is one of your top recommended options for short-term disability insurance because the premiums are affordable, and they offer additional benefits and coverage to those who qualify.

2. Northwestern Mutual

Along with short-term disability insurance, Northwestern Mutual also offers life insurance, financial planning, and investments. This is ideal for anyone who wants to better plan their financial longevity.

With experience that spans 150 years, Northwestern Mutual is a preferred option for countless people who understand the value of short-term disability insurance. A variety of policies are offered at different price points.

This insurer also requires you to speak to an agent to get a quote on a policy, but this is how they’re able to provide more personalized advice.

Depending on the benefits, premiums start from as little as $25 per month, making it one of the more affordable options on the market.

3. State Farm

State Farm is one of the few insurance providers that offer short-term disability benefit periods as long as three years. Depending on your job title and income, monthly benefits range from $300 – $3,000.

This insurance provider currently holds an A++ financial strength rating, which is the highest rating you can achieve. Policies are available across 47 states and are a popular choice because the application process is said to be a lot faster and simpler than other providers. This is mainly because no medical exam is required to apply.

It should be noted, however, that limited coverage is offered for mental and nervous impairments. Anyone who suffers complications following a cosmetic procedure also won’t be covered.

The average premium ranges from $10 – $40 per month, and elimination periods are between 30 and 90 days.

4. Assurity

Over and above short-term disability insurance, Assurity also specializes in accident, life, and critical illness insurance. Car, health, and household insurance are also available, ensuring your income is protected in almost any situation.

Assurity is a top choice for this type of insurance because it has a higher cap for monthly payout limits, with the highest payout being $20,000 per month. Naturally, this is all dependent on your occupation as well as your income.

Founded in 1890, Assurity has a long history in this sector and currently offers policies in 49 states. It has also achieved an AM Best rating of A-, which is a rating of ‘excellent’.

This provider pays an average of 60% – 70% of a person’s monthly income. The average premium ranges from $30 – $70 per month, and elimination periods are between 30 and 90 days. Partial benefits are also available should you be able to return to work on a part-time basis.

5. Haven

Haven is one of the few providers of short-term disability insurance that has a 100% digital application process, offering speed and convenience.

With a maximum payout of up to $5,000 or up to 60% of your income, Haven is an excellent choice for anyone who doesn’t fall into higher income brackets. You can also enjoy guaranteed policy renewal up until the age of 65.

Even though Haven is one of the newer insurance providers on the block, they’ve still managed to achieve a financial strength rating of A++.

Premiums start from as little as $10 per month, and a 14-day elimination period is available. However, Haven isn’t available in all states – CA, ND, DE, SD, FL, NY, MT, and WY are excluded.

6. Breeze

The final recommendation on our list is Breeze – an insurer that has been around since 2019. Breeze has become a popular short-term disability insurance option for self-employed individuals, mainly because the quotation and sign-up process is quick and easy.

Even though they haven’t been around for as long as some of the other providers on this list, they have still achieved an AM Best rating of A-.

A stand-out feature of Breeze is that you’re able to customize your plan based on your income. You can choose between minimal coverage and more inclusive coverage based on your risk profile and receive a premium estimate in as little as 30 seconds.

And because Breeze is more digital-focused, you can easily manage your insurance policy from their website at any time of the day or night.

Coverage ranges from $200 – $2,000 per month, depending on your plan. Premiums start from just $7 per month, making it accessible to most working Americans, and elimination periods range from one to 30 days.

Is Short-Term Disability Insurance Worth It?

This is really only a decision you can make, but when you consider that around 5% of working Americans (2) will become temporarily disabled due to illness or injury, this type of insurance does make sense.

Not receiving an income for six months or less could be enough to bankrupt you and disrupt the financial security you’ve been building up for your retirement. What’s more, if you’re currently supporting a spouse or children, a temporary disability could be detrimental.

When you consider how low some of the short-term disability insurance premiums are, giving yourself some added peace of mind is a good investment and one that’s easy to achieve.

In Closing

Short-term disability insurance is not something you need to have. However, it’s better to have it than not need it instead of not having it and finding yourself in a trying financial situation. You never know when an injury or illness might strike, but you can prioritize your financial security through insurance policies.

Short-Term Disability Insurance FAQs

This particular type of policy is designed to only pay benefits for a short period of time. This can range from three months to one year, depending on the policy and provider you decide on. You should also take the elimination period into consideration which is the period between when injury or illness occurs and benefits start paying out. Short-term insurance policies are popular because of the peace of mind and short-term financial security they provide.

Your short-term disability rate or premium is based on the amount of money you receive every year for your full-time role. Any additional income is not included in this calculation. To calculate an STD rate, divide your annual salary by 12 – this will give you your gross monthly salary. Next, divide your gross monthly salary by 100. Lastly, divide this figure by the coverage rate of your insurer to calculate your monthly premium. Coverage rates differ, which is why premiums will differ per insurer too.

In most instances, short-term disability coverage ranges from 30 days to one year, but this depends on your provider. After the first year, you may want to consider long-term disability coverage. Short-term disability policies can also be renewed if need be.